What Is The Minimum Income For Child Tax Credit 2025. Various family tax credits and deductions, including the 2025 child tax credit have been adjusted for inflation. How much is the new child tax credit?

If the new tax deal is passed by the senate, the ctc. The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2025 tax year.

The american rescue plan raised the maximum child tax credit in 2025 to $3,600 for children under the age of 6 and to $3,000 per child for children between ages.

Child Tax Credit 2025 Limits What is the limits for this, The maximum credit is set to increase with inflation in 2025. If you have one child and your adjusted gross income was $46,560 (filing alone) or $53,120 (filing jointly with a spouse) in 2025, you could claim up to $3,995 in a.

Understanding the Child Tax Credit A Guide for Employers, The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2025 tax year. How much is the tax credit per child?

2025 Child Tax Credits Form Fillable, Printable PDF & Forms Handypdf, In effect, the parent's ctc would double to $3,150 for each tax year. This means that even if you filed already for 2025, you may be.

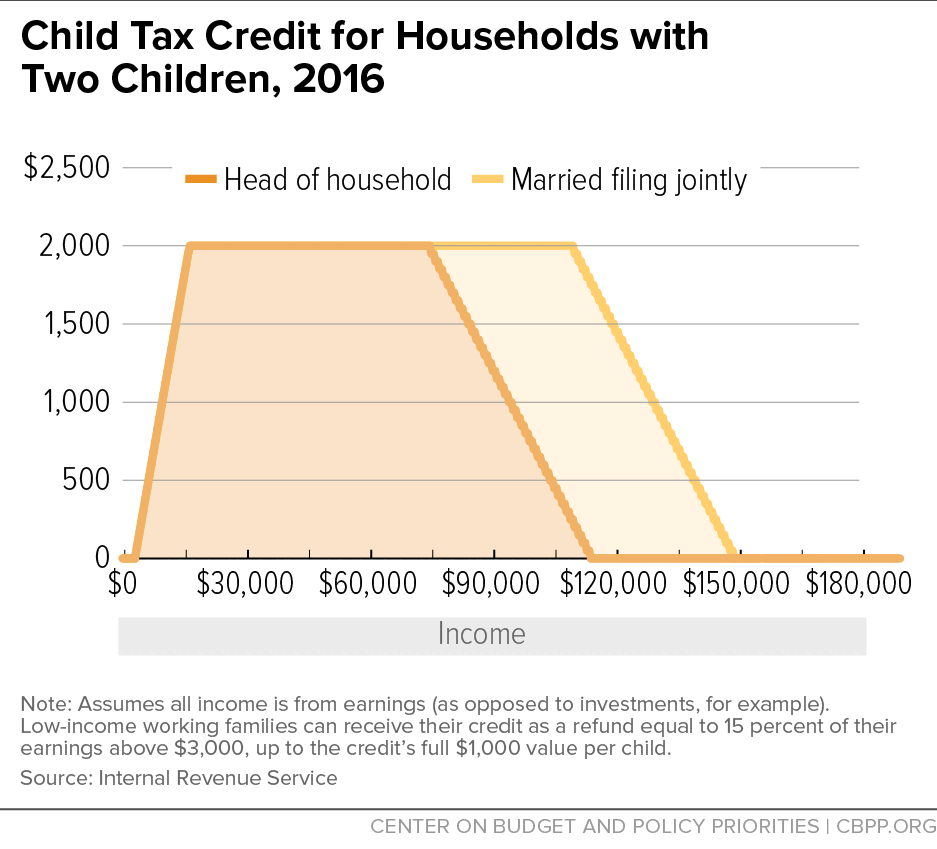

What Is Child Tax Benefit, The increased child tax credit is reduced by $50 for every $1,000 income above the thresholds. Go to child disability benefit.

Child Tax Credit Payments (06/28/2025) News Affordable Housing, Only a portion is refundable this year, up to. The maximum tax credit per child is $2,000 for tax year 2025.

3600 Child Tax Credit 2025 Know How to Claim, Payment Date & Eligibility, The refundable additional child tax credit can reduce your tax to zero and, if there’s credit left over, you’ll get money back. Various family tax credits and deductions, including the 2025 child tax credit have been adjusted for inflation.

Child tax credit How to know if you qualify, how much you'll get paid, The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Go to child disability benefit.

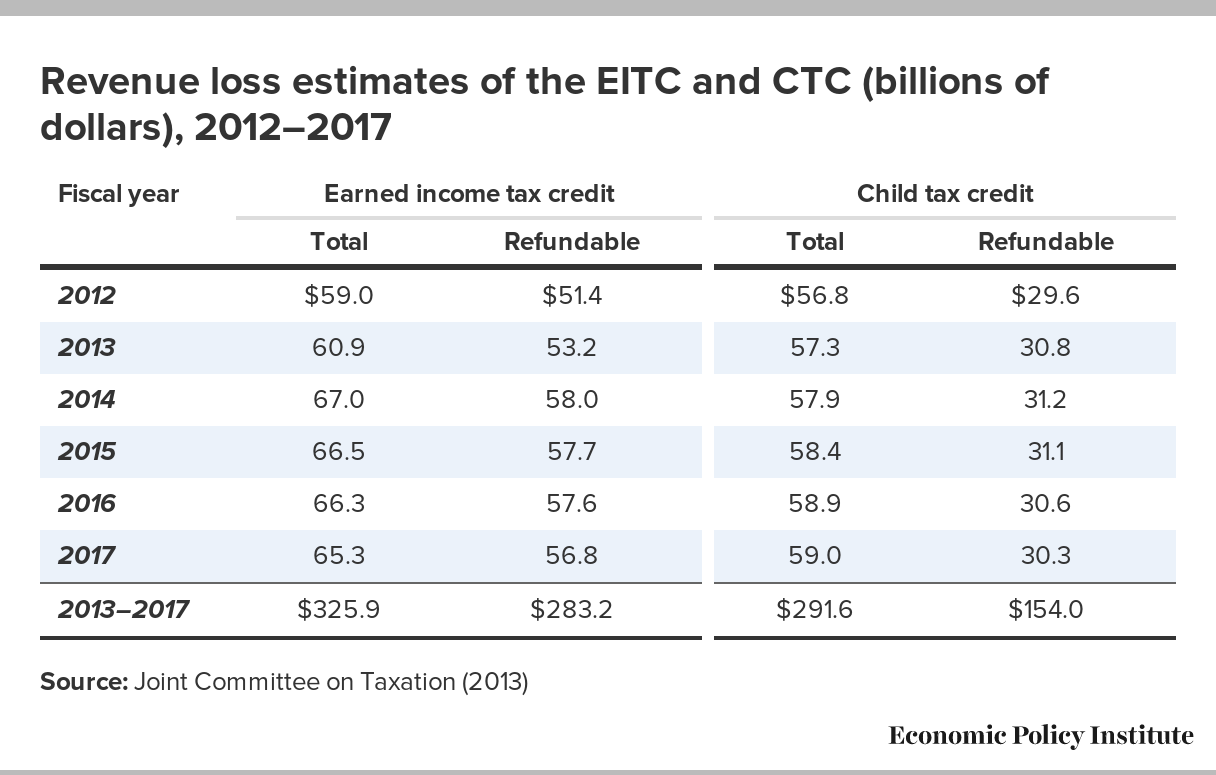

Chart Book The Earned Tax Credit and Child Tax Credit Center, For instance, if you are filing for a single return and your annual. Only a portion is refundable this year, up to.

Child Tax Credit / These Two Charts Show How The Gop S Proposed Tweaks, The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2025 tax year. The refundable additional child tax credit can reduce your tax to zero and, if there’s credit left over, you’ll get money back.

The American Families Plan Too many tax credits for children? Brookings, The value of the child tax credit and additional tax credit decreases if the parent or guardian's gross income is more than $200,000 when filing individually, or. 2025 to 2025 2025 to 2025 2025 to 2025;