With great pleasure, we will explore the intriguing topic related to Google Stock Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Google, the tech giant that has revolutionized the way we live, work, and communicate, has consistently been a top performer in the stock market. As the company continues to innovate and expand its product offerings, investors are eagerly looking ahead to its future prospects. This comprehensive analysis will explore the factors that are likely to shape Google’s stock performance in the years to come, culminating in a comprehensive forecast for 2025.

The technology industry is expected to continue its rapid growth trajectory, driven by advancements in artificial intelligence, cloud computing, and data analytics. Google is well-positioned to capitalize on these trends, as it has a strong presence in all of these areas. The company’s cloud computing platform, Google Cloud, is one of the largest in the world, and its AI capabilities are among the most advanced.

Google’s financial performance has been consistently strong in recent years. The company has reported steady growth in revenue and earnings, driven by its core advertising business as well as its newer initiatives in cloud computing and hardware. In 2025, Google’s revenue reached $257.6 billion, with earnings per share of $116.54.

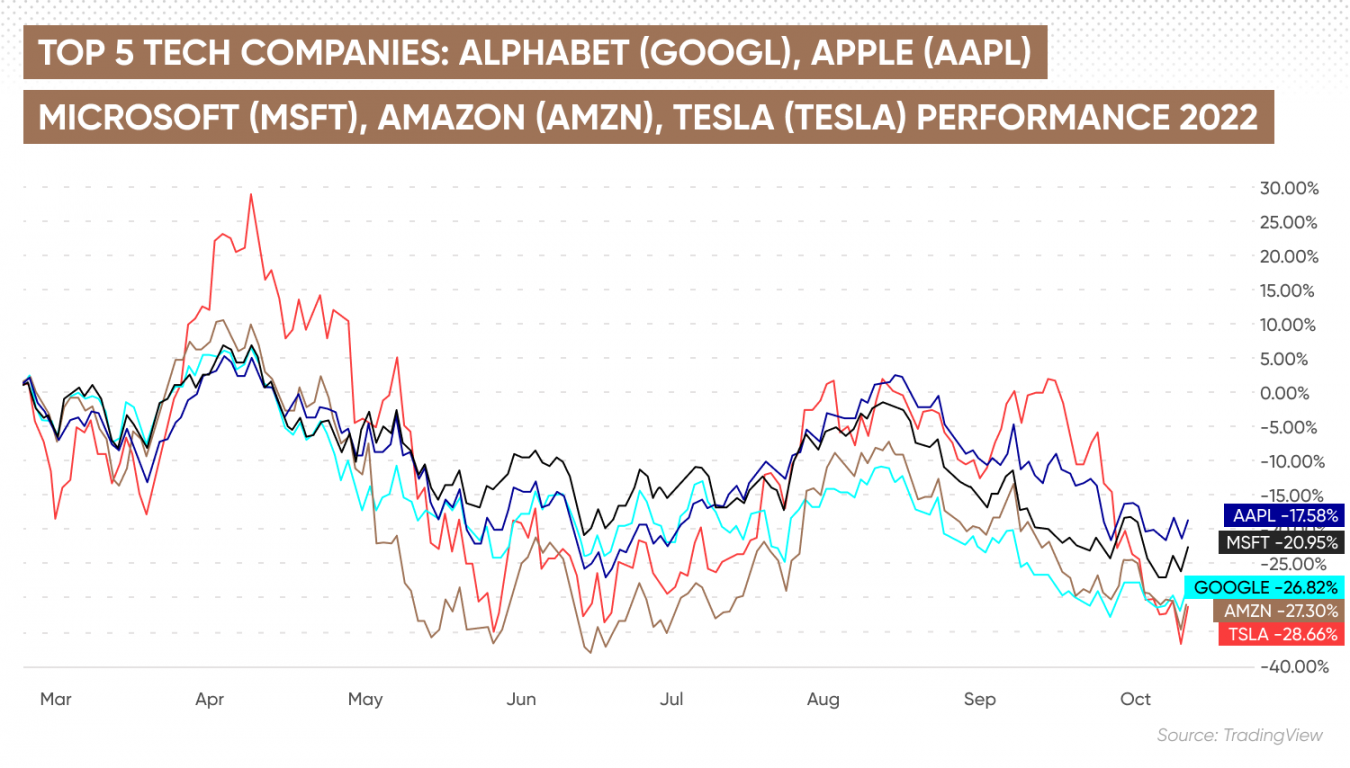

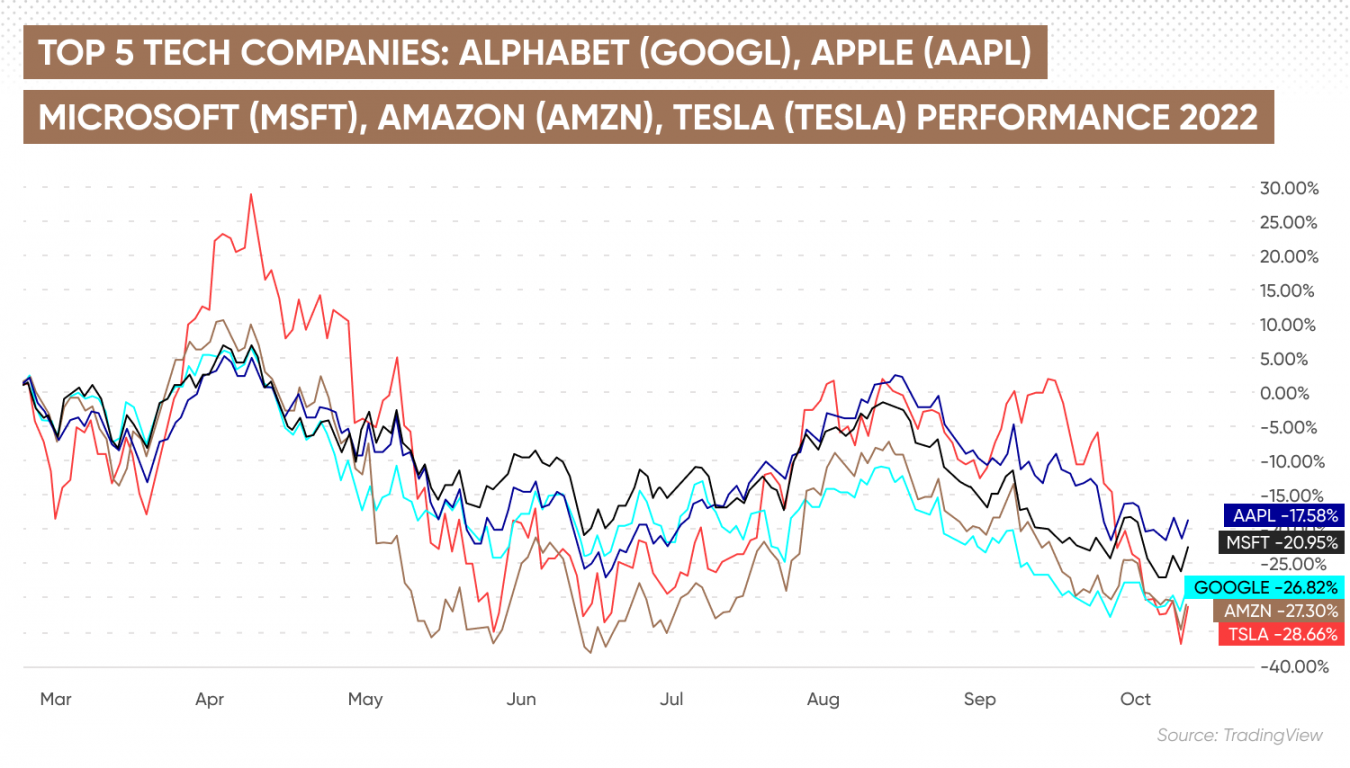

Google faces intense competition from other tech giants, such as Amazon, Microsoft, and Apple. However, the company has a number of advantages that set it apart from its rivals. Google’s search engine is the most popular in the world, and its Android operating system powers over 80% of the world’s smartphones. These dominant market positions provide Google with a significant competitive edge.

Google has a number of growth drivers that are likely to continue to fuel its success in the years to come. These include:

Google’s stock is currently trading at around $110 per share. The company’s forward price-to-earnings ratio (P/E) is 20, which is in line with other tech giants. Google’s PEG ratio, which measures a stock’s valuation relative to its earnings growth rate, is 1.5, which is considered to be fair value.

There are a number of risks that could affect Google’s stock performance in the future. These include:

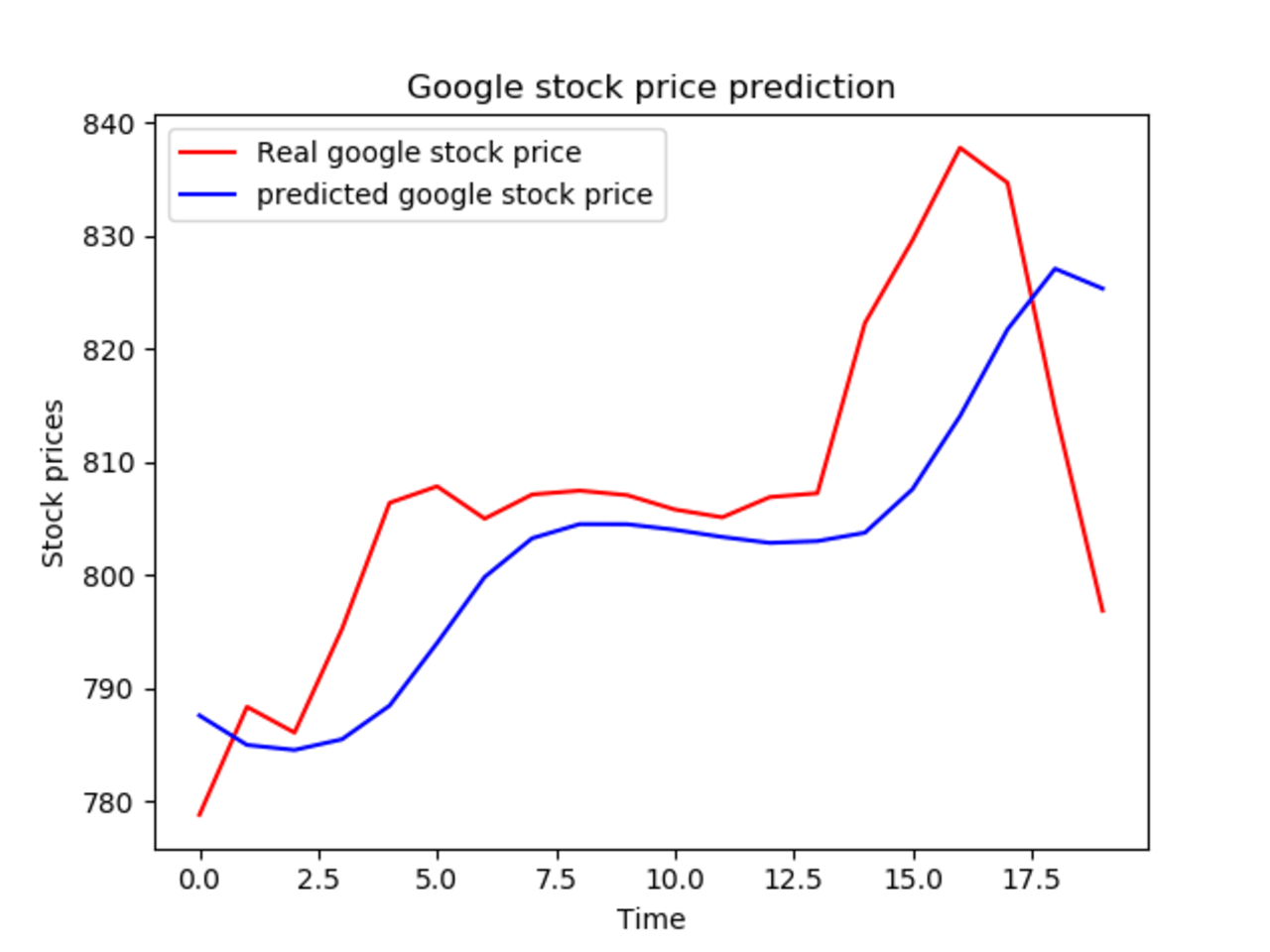

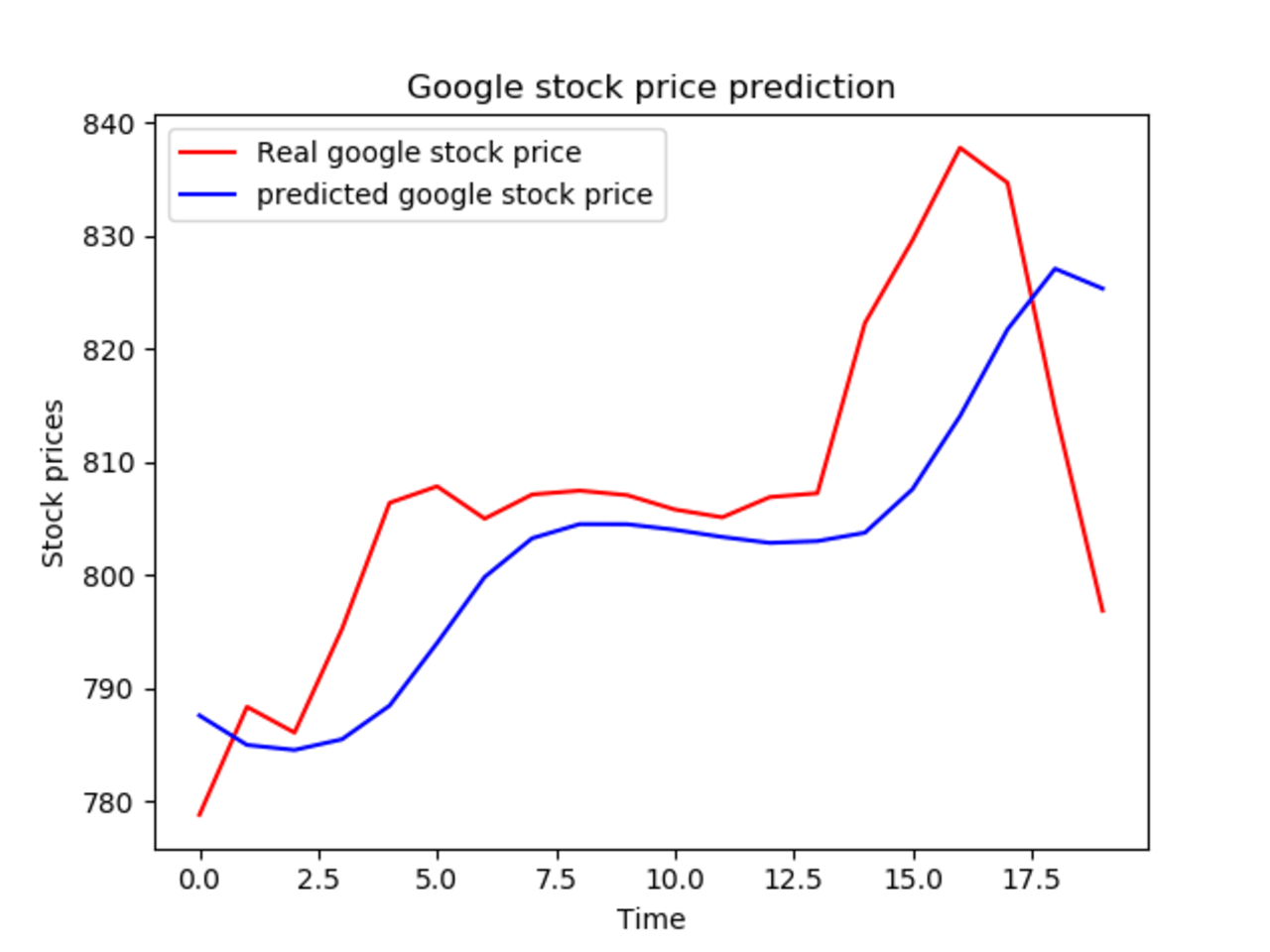

Taking into account all of the factors discussed above, it is reasonable to expect that Google’s stock will continue to perform well in the years to come. The company has a strong track record of innovation and financial performance, and it is well-positioned to benefit from the continued growth of the technology industry.

Based on a conservative estimate, it is possible that Google’s stock could reach $150 per share by 2025. This would represent a return of approximately 36% over the next three years.

Google is a well-established tech giant with a strong track record of innovation and financial performance. The company is well-positioned to continue to benefit from the growth of the technology industry, and its stock is likely to continue to be a good investment for years to come. Based on a conservative estimate, it is possible that Google’s stock could reach $150 per share by 2025, representing a return of approximately 36% over the next three years.

Thus, we hope this article has provided valuable insights into Google Stock Forecast 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!